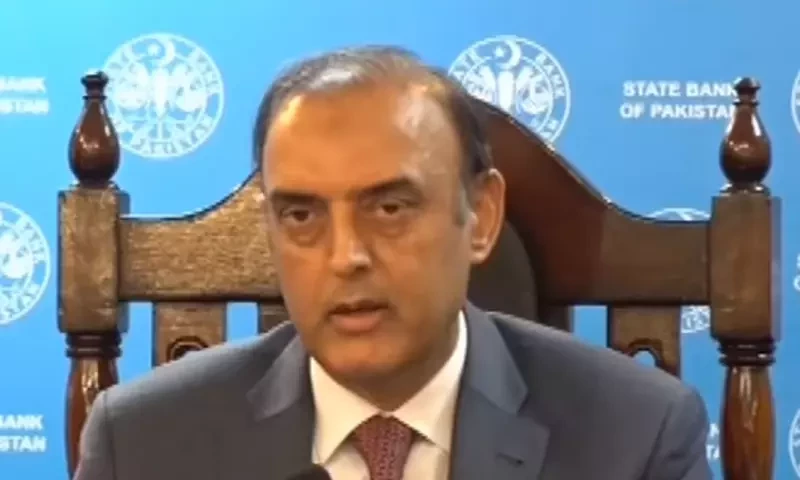

The Governor of the State Bank of Pakistan (SBP), Jameel Ahmed, has suggested a possible reduction in the monetary policy rate, attributing this to the ongoing decline in inflation, which has favorably influenced the monetary policy committee’s decisions.

During a media briefing in Karachi, Ahmed highlighted the significant improvement in the government’s financial standing, which has alleviated the pressure on banks to repay loans early and reduced public borrowing needs. He announced the licensing of five digital banks, with full digital banking services expected to launch by 2025. One of these banks is set to begin operations within the next three months, as part of the regulator’s efforts to strengthen the financial ecosystem, particularly through expanded SME financing, projected to grow from Rs. 550 billion to Rs. 1.1 trillion over the next five years.

The governor also confirmed that Pakistan’s foreign exchange reserves have reached $10 billion, bolstered by a $1 billion tranche from the International Monetary Fund, which is sufficient to cover two months of imports. He reassured the public that the supply of dollars remains stable and that there is no pressure on the rupee in the foreign exchange market.

READ MORE: Iran Issues Warning to Israel Amid Rising Tensions

Additionally, Ahmed noted a rise in online fraud within banking systems, prompting the SBP to issue warnings to banks to enhance their cybersecurity measures.