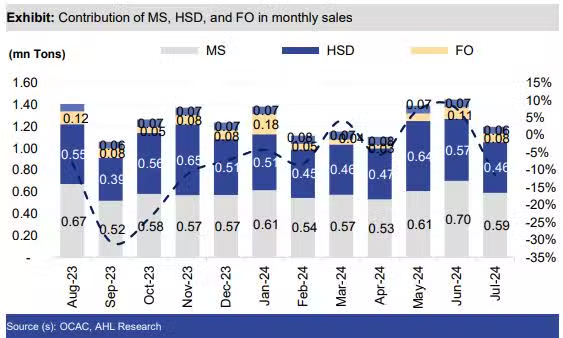

In July 2024, total petroleum sales reached 1.20 million tons, reflecting an 11 percent year-on-year (YoY) decline. According to Arif Habib Limited, this reduction in offtake was driven by a hike in the prices of Motor Spirit (MS) and High-Speed Diesel (HSD), leading to lower consumption, the availability of smuggled petroleum products from Iran, and a decreased demand for Furnace Oil (FO)-based power generation.

MS sales dropped by 10 percent YoY in July 2024, amounting to 0.59 million tons. Similarly, HSD offtake fell by 6 percent YoY, settling at 0.46 million tons. FO sales experienced a significant decline of 46 percent YoY, reaching 0.08 million tons.

READ MORE: Pakistan’s Trade Deficit Expands by Almost 20% in July

On a month-on-month (MoM) basis, petroleum product dispatches contracted by 17 percent in July 2024 due to the aforementioned factors. MS offtake plummeted by 16 percent MoM, while HSD dispatches decreased by 18 percent MoM. FO sales reduced by 27 percent MoM.

Petroleum Sales Drop by 11% in July 2024

On a company level, Pakistan State Oil (PSO) saw its sales drop by 19 percent YoY to 0.55 million tons in July 2024. PSO’s offtake of MS, HSD, and FO decreased by 22 percent, 22 percent, and 17 percent YoY, respectively. Meanwhile, Shell (SHEL), Hascol Petroleum Limited (HASCOL), and Attock Petroleum Limited (APL) witnessed YoY declines of 8 percent, 12 percent, and 23 percent, respectively, in July 2024.

PSO’s market share decreased by 4.6 percent, settling at 45.6 percent in July 2024 compared to 50.2 percent in July 2023. APL’s market share dropped by 1.2 percent, arriving at 8.5 percent YoY. On the other hand, SHEL’s market share in July 2024 was 7.2 percent, slightly up from 7.0 percent in the same period last year. HASCOL’s market share remained unchanged at 3.2 percent. Lastly, other Oil Marketing Companies (OMCs) saw their market share increase by 5.6 percent, reaching 35.4 percent in July 2024.