Pakistan’s tax budget was rewritten recently, which led to the increase income taxes, sales regulatory duties, and much more. This led to a rise in the cost of imported mobile phones.

The increase in price is significant due to the fact that the tax that will be applied to phones priced above $200 is at a whopping 17 percent. Pakistan Telecommunication Authority (PTA) has revealed the tax rates you’ll be required to pay on smartphones at various price points. The list includes phones of all price ranges, from low-end phones right to high-end handsets such as Samsung Galaxy S21/iPhone 13, and so on.

The tax fixed on smartphones priced between $201 and $350 has been increased from Rs. 1,750 to an astonishing 14,661.. 14.661. Handsets that cost between $351 and $500 are now taxed at from Rs. 23,420. Phones costing more than $500 will be taxed at in the amount of Rs. 37,000 and more. Here’s the complete list:

- $1 to $30 = Rs. 430

- $31 to $100 = Rs. 3,200

- $101 to $200 = Rs. 9,580

- $201 to $350 = Rs. 12,200 + 17% Sales Tax

- $351 to $500 = Rs. 17,800 + 17% Sales Tax

- $501 and more is equivalent to Rs. 36,870 + 17% Sales Tax

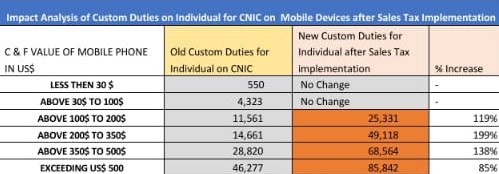

This is applicable to smartphones purchased by the Passport ID. The taxes that are imposed upon CNIC imports are more severe. Here’s the list:

- $1 to $30 = Rs. 550

- $31 to $100 = Rs. 4,323

- $101 to $200 = Rs. 11,561

- $201 to $350 = Rs. 14,661 + 17% Sales Tax

- $351 to $500 = Rs. 23,420 + 17% Sales Tax

- $501 and more is equivalent to Rs. 37,007 + 17% Sales Tax

The Federal Bureau of Revenue (FBR) has released a photo of the new tax in addition to comparing the amount of taxes that were in place against the new taxes.

If you’re wondering why taxes have risen significantly The Premier Imran Khan recently clarified the reasons through an interview. He claims he would like to boost local production of smartphones in Pakistan and wants to cut down on billions of dollars worth of imports as it could hurt the value of PKR. Read the full interview below.